The Government of Australia informed the citizens on April Fool’s Day (April 1st 2016) in press release headed ‘Government decision on financial assistance relating to the collapse of Trio Capital’ saying,

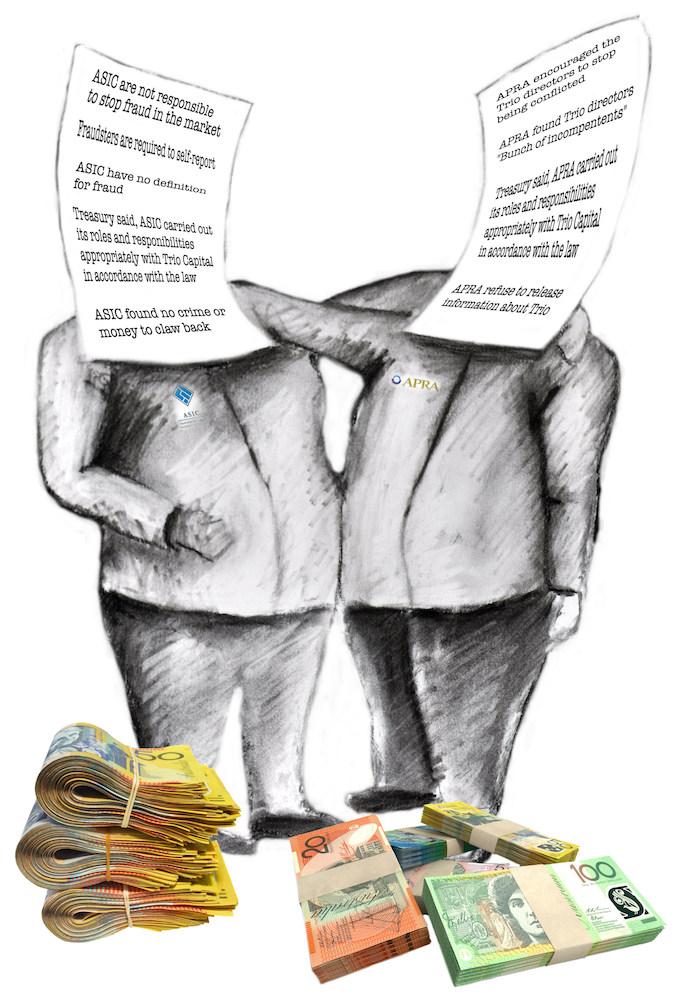

"The Government considered the action taken by the financial regulators, ASIC and APRA, and is satisfied that in relation to the collapse of Trio, both regulators carried out their roles and responsibilities appropriately, in accordance with the law and the regulatory framework." 1

1. Government decision on financial assistance relating to the collapse of Trio Capital April 1st 2016 http://kmo.ministers.treasury.gov.au/media-release/032-2016/

The press release was echoed in a manner by a number of national media outlets, each with their individual header and the headers reflecting a perceived intention to mislead the public. Some of the press headers said:

• No more taxpayer support for victims of Trio collapse - Sydney Morning Herald

• Government vetoes SMSF fraud compo – Australian Financial Review

• Trio Capital compensation halted - Independent Financial Adviser (online)

• Trio Capital compensation complete - financial standard (online)

• No further compensation for Trio direct and SMSF investors moneymanagement (online)

• Government makes call on Trio Capital compensation smsfadviseronline (online)

• Government denies Trio compensation smsmagazine (online)

Statements such as, ‘no more taxpayer support’ (there never was any taxpayer support) and ‘compensation halted’ would need to have already started to be able to stop, are misleading. In addition, the use of the word compensation, when the victims referred to restitution is also misleading.

Some of the public feel misled when they hear the government says the Australian Security and Investments Commission (ASIC) and the Australian Prudential Regulatory Authority (APRA) carried out their work appropriately. No information has been made publicly available to show how the government reached this decision about the regulators. What were the terms of reference used in assessing ASIC and APRA, who carried out the assessment or did the government rely on the regulators own self-assessment?

More questions could be raised such as, was the assessment of their regulatory roles based on the information presented to government by the regulators? It is already public knowledge that ASIC was selective in deciding what information it provided the Parliamentary Inquiry into the Collapse of Trio Capital. The PJC Report said,

The committee has been unable to obtain clear answers or evidence from ASIC, APRA or the AFP as to whether any attempts have been made to bring charges against Flader and others, to have them extradited to Australia, or even as to whether their names are on a watch list for people passing through Australian airports. There have been no examinations on oath of Mr Flader or any person other than Mr Richard and Mr Eugene Liu. 2

2. Parliamentary Joint Committee on Corporations and Financial Services Inquiry into the collapse of Trio Capital May 2012 page xxi

It is perceivable that from the beginning ASIC have managed the outcome of the Astarra / Trio fraud to fit their own damage control. From the start it is apparent that justice is unimportant when in comes to preserving the reputation, consumer confidence and stability of the financial system.

ASIC took six months from being notified that Astarra Strategic fund might be a Ponzi until ASIC finally acknowledged that the missing assets were indeed missing. From this early period it appears ASIC compromised a proper investigation into the international crime by focusing on local issues. The international element and the few individuals who were part of the international gang were overlooked and ignored. ASIC focused on local Australian based operators of the Trio Capital scheme and was able to find something against them to issue Enforceable Undertakings but this action had nothing to do with understanding where the bulk of the missing money is / went.

Part of the interaction between ASIC and the AFP can be gauged from documents obtained under Freedom of Information (FOI) from the AFP in 2015. The document in question is ASIC’s correspondence dated June 21 2012 to the Australian Federal Police (AFP) in which ASIC write,

‘Trio was a funds management group based in Albury, NSW and provided a complex suite of managed investment funds which were heavily marketed through several financial advisors in Australia. These financial planners earned fees and commissions based on investments into Trio funds…It is alleged that financial advisers provided recommendations to clients due to high commissions which were paid by Trio It is further alleged that the complex structure of the Trio scheme was designed to conceal fraudulent activity.’ 3

3. FOI No 373 (VOFF reference) received from AFP September 29 2015

In the correspondence to the AFP ASIC make no mention of the overseas people behind Trio who have previously been before the courts over financial matters. ASIC also note that ‘the material provided by ASIC does not provide sufficient information to support an investigation into any Criminal Code Act 1995 offences…’

ASIC’s correspondence shows no enthusiasm to determine what happened or to bring before the courts those responsible. ASIC demonstrate they have given up before they even start.

The Parliamentary Joint Committee note,

The committee is surprised that there appears to have been very little follow up activity by APRA, ASIC and other authorities such as the AFP, to seek to recover outstanding moneys or to bring to justice those who have committed crimes which have led to great suffering on the part of Australian investors. 4

4. PJC Report May 2012 Op cit. page xxi

The PJC Report captures one group of government agents nurturing another government agent to set right their organisational responsibilities,

The committee believes there are significant policy steps required to better protect against the threat to Australia's superannuation system from criminals. These include:

(a) a dedicated focus within the AFP to detecting and combating superannuation fraud;

(b) more detailed scrutiny by APRA of the 'trigger points' at which criminals take control of superannuation vehicles;

(c) a much more vigorous criminal investigation, involving ASIC, APRA and the AFP, into the Trio fraud, with a view to pursuing the maximum available criminal sanctions against those responsible; and

(d) legislation to allow assets to be recovered from those personally involved in fraud and theft, with the proceeds to go towards compensating those who have lost money as a result of the fraud and theft. 5

5. PJC Report May 2012 Op cit. page xxv

The policy steps put forward by the Parliamentary Joint Committee had already been established before 1997. Australia is signatory to the Financial Action Task Force (FATF) agreeing to methods and processes for detecting fraud, dismantling and unravelling fraud including ongoing protection against fraud.

Rick McDonell of the NSW National Crime Authority, said at the Australian Institute of Criminology conference in 7-8 May 1998,

In the last few decades crime has become more organised, more sophisticated and increasingly international in nature. It has also become more profitable. In response, many countries have developed legislative, law enforcement and financial sector initiatives to deal with organised crime. A key initiative has been to increase the focus on financial aspects of crime. One aim of this approach is to identify criminal assets in order to facilitate their confiscation. Another is to use the investigation of suspicious financial activities as a means to detect previously unknown criminal activities. A third is to use financial trails to provide an evidentiary link between key organisers and specific criminal acts. 6

6. McDonell, Rick National Crime Authority, NSW Money Laundering Methodologies and International and Regional Counter-Measures May 1998 page 2

The above understanding of sophisticated financial crime illustrates that the methods used by the Astarra Strategic Managed Investment Scheme was already recognised. The only apparent reason ASIC and APRA did not recognise Astarra can only be assumed that they their were asleep at the wheel.

McDonell, noted the trends in globalization provided benefits for criminals in the laundering of their proceeds. Larger volume of legitimate capital moving at any one time in the world and the rapidly reducing official controls on that movement have made it possible for large amounts of proceeds of crime to enter world markets without attracting much attention. McDonell writes,

The increased need for criminal enterprises to use international funds transfers have also made them aware of the benefits of moving funds internationally to disguise them, effectively disrupting audit trails as law enforcement is stymied by jurisdictional and legal boundaries. In addition, the growing diversification of international financial instruments and the differences in controls in regulation between countries has provided those wishing to disguise funds with ample opportunity to do so. 7

7. McDonell, Rick Op Cit. May 1998 page 8

McDonell raises some of the most obvious reasons to establish money laundering counter-measures are to stop criminals from achieving the benefits of money laundering. Specifically:

• to stop them from enjoying the personal benefits of their profits (this may act as a deterrent as well as a punishment);

• to prevent them from reinvesting their funds in future criminal activities (that is to strip them of their working capital base); and

• to provide law enforcement with a means to detect criminal activities through the audit trail and to provide an evidentiary link for prosecution purposes between criminal acts and major organisers. 8

8. McDonell, Rick Op Cit. May 1998 page 9

On each of the above points it is safe to say that ASIC totally failed to uphold basic money laundering counter-measures.

McDonell points to what can easily be perceived as ASIC’s reason not to uncover the details of the Astarra / Trio crime. McDonell says,

The main negative consequence is the impact money laundering can have on the stability of the financial system. A large scale money laundering operation, involving one or more of a country's financial institutions could, once detected, put at risk a smaller nation's entire financial system through the loss of credibility and investor confidence.9

9. McDonell, Rick Op Cit. May 1998 page 9

None of the above information is too hard or beyond ASIC capabilities. ASIC have clearly shown that something else is percolating other than ensuring an accurate investigation with the public interest in mind is carried out. The Financial and Regulatory Money Laundering Countermeasures points raised by McDonell can be found in The Financial Action Task Force Forty Recommendations 1996 and the Prevention of Criminal Use of the Banking System for the Purpose of Money Laundering 1998.

Listing a number of financial and regulatory measures that have been proposed, McDonell writes:

• an end to anonymous accounts in financial institutions and a requirement that they record and maintain records of the identity of their clients (commonly known as the 'know your customer' policy);

• special attention to be paid to complex, unusual and large transactions with some proposing that institutions be required to report such transactions to competent authorities;

• countries to consider implementing measures to detect or monitor cash at national borders; and

• the development of programmes in financial institutions to guard against money laundering including internal controls and employee training. 10

10. McDonell, Rick Op Cit. May 1998 page 12

Again the above measures are not extraordinary. ASIC should be familiar with such money laundering counter-measures put in place over a decade ago. Why ASIC failed to uphold the counter-measures and also why are the government claiming, “both regulators carried out their roles and responsibilities appropriately, in accordance with the law and the regulatory framework”

Australian citizens deserve to have both questions answered by a non-government independent body.